Fund The Future

You Deserve.

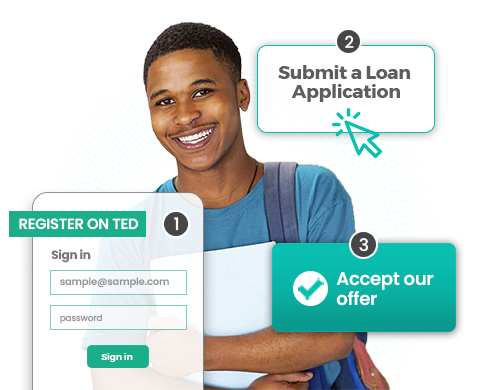

Flexible financing for undergraduate or postgraduate studies. Go further with a Ted student loan.

Scan to download

Powered by

Features and benefits

If you are a full-time undergraduate student, you will need your parent or guardian to apply and pay off the loan.

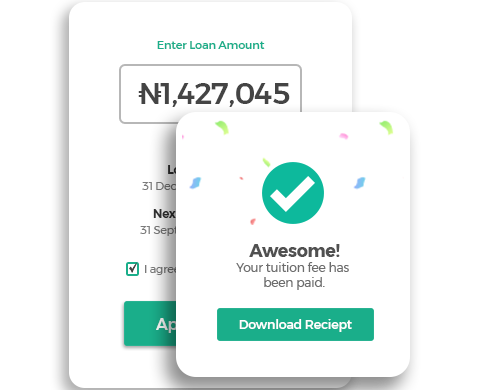

- Repayments are made up of the loaned amount and its monthly interest from the start of the loan term.

- Tuition fee loans, to cover the full cost of your course, are paid directly to the course provider.

With us you can have the peace of mind of knowing that your fees, books, accommodation and other costs are covered while you focus on your studies.

Student loans to cover your tuition fees

You are eligible for student finance, provided you meet some basic criteria:

- Residency – you’re a Nigerian or have resident status.

- Your university or college – you’re studying at an approved university or college (studying a course approved for funding).

- Your course – you’re studying a recognised full-time course e.g. a bachelors degree, a masters degree or a Higher National Diploma (HND).

Frequently Asked Questions

Copyright Ⓒ2023 Ted Integrated Solutions Ltd

Email: info@ted.ng

Copyright Ⓒ2023 Ted Integrated Solutions Ltd